How to do monthly cash flow?

Average your actual expenses over a three month period to come up with a reliable monthly estimate for your total expenses. Subtract your monthly expense figure from your monthly net income to determine your leftover cash supply.

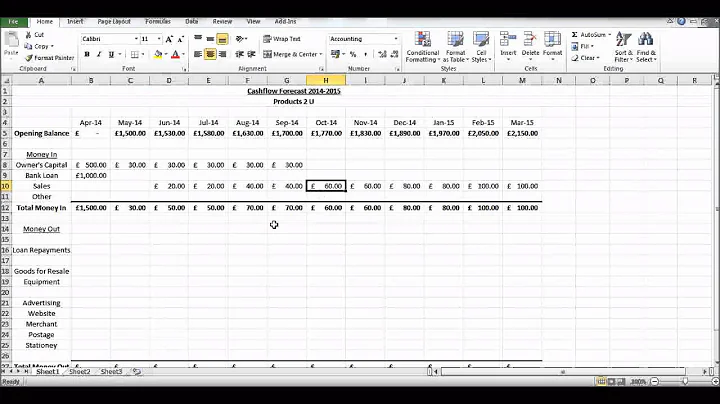

- Decide how far out you want to plan for. Cash flow planning can cover anything from a few weeks to many months. ...

- List all your income. For each week or month in your cash flow forecast, list all the cash you've got coming in. ...

- List all your outgoings. ...

- Work out your running cash flow.

To calculate free cash flow, add your net income and non-cash expenses, then subtract your change in working capital and capital expenditure.

Cash flow statements can be prepared monthly, quarterly, yearly, or for any period you determine to be most helpful. Most businesses find keeping track each month is beneficial.

- Bring your ending cash total forward. ...

- Estimate sales. ...

- Estimate other revenue. ...

- Estimate regular expenses. ...

- Estimate seasonal or one-time expenses. ...

- Subtract expenses from income. ...

- Add beginning balance to estimated cash flow.

Generally speaking, cash flow of at least $100-$200 per unit can be considered good.

The easiest way to calculate cash flow using the direct method is to look at the changes in balances on the balance sheet. An increase in assets and liabilities means cash is coming into the business while decreasing assets and liabilities means cash moving out. Indirect cash flow is more complicated.

Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure. Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital. Cash Flow Forecast = Beginning Cash + Projected Inflows – Projected Outflows = Ending Cash.

What is a cash flow example? Examples of cash flow include: receiving payments from customers for goods or services, paying employees' wages, investing in new equipment or property, taking out a loan, and receiving dividends from investments.

So, is cash flow the same as profit? No, there are stark differences between the two metrics. Cash flow is the money that flows in and out of your business throughout a given period, while profit is whatever remains from your revenue after costs are deducted.

Is cash flow calculated monthly or yearly?

A cash flow statement shows the exact amount of a company's cash inflows and outflows, either monthly, quarterly, or annually.

The metric of cash flow is constantly changing. It must be tracked regularly during a specific time. So, building cash flow forecasts weekly, monthly, quarterly, or yearly is relevant. The firm's demands will determine which time span is the most useful.

Average Monthly Cash Flow means, with respect to any period of any Person, the sum of the Cash Flow of such Person for each month (and pro rata portion thereof) during such period divided by the number of months (and pro rata portion thereof) in such period.

A cash flow budget is an estimate of all cash receipts and all cash expenditures that are expected to occur during a certain time period. Estimates can be made monthly, bimonthly, or quarterly, and can include nonfarm income and expenditures as well as farm items.

Investors and experts alike regard return on investment (ROI) as the most important aspect of evaluating the profitability of a real estate investment. It is generally recommended to aim for an ROI of 10-15%.

While it's perfectly fine to get some financial backing from business loans, a healthy cash flow ratio should be relatively low on financing cash. In the simplest terms, a healthy cash flow ratio occurs when you make more money than you spend.

The definition of the 1% rule is quite simple. The rule states that an investment property's gross monthly rent income should equal or surpass 1% of the purchase price. This rule helps predict whether a commercial real estate property will provide positive cash flow.

A cash flow problem occurs when the amount of money flowing out of the company outweighs the cash coming in. This causes a lack of liquidity, which can inhibit your ability to make payments to suppliers, repay loans, pay your bills and run the business effectively.

Free cash flow = sales revenue - (operating costs + taxes) - required investments in operating capital. Free cash flow = net operating profit after taxes - net investment in operating capital.

The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. This value can be found on the income statement of the same accounting period.

What is free cash flow for dummies?

What is free cash flow? Free cash flow, or FCF, is the money that is left over after a business pays its operating expenses (OpEx), such as mortgage or rent, payroll, property taxes and inventory costs — and capital expenditures (CapEx).

Cash flow is a measure of how much cash a business brought in or spent in total over a period of time. Cash flow is typically broken down into cash flow from operating activities, investing activities, and financing activities on the statement of cash flows, a common financial statement.

- Revenue from customer payments.

- Cash receipts from sales.

- Funding.

- Taking out a loan.

- Tax refunds.

- Returns or dividend payments from investments.

- Interest income.

Pricing a business for sale requires evaluating its cash flow—another name for a business's earnings before interest, taxes, depreciation, amortization and owner's compensation are subtracted.

Key Takeaways. Revenue is the money a company earns from the sale of its products and services. Cash flow is the net amount of cash being transferred into and out of a company.

References

- https://www.investopedia.com/terms/l/liquidasset.asp

- https://fastercapital.com/content/Liquidity--Understanding-the-Liquidity-Characteristics-of-Feeder-Funds.html

- https://unacademy.com/content/cbse-class-11/study-material/ocm/economic-activities/

- https://www.bdc.ca/en/articles-tools/money-finance/manage-finances/5-tips-manage-cash-flow

- https://www.brex.com/journal/what-are-liquid-assets

- https://www.realtor.com/advice/finance/house-rich-cash-poor-meaning/

- https://thesaleshunter.com/your-3-greatest-assets-time-mind-and-network/

- https://www.investopedia.com/investing/what-is-a-cash-flow-statement/

- https://byjus.com/question-answer/what-are-the-three-types-of-activities-in-a-cash-flow-statement/

- https://www.experian.co.uk/blogs/latest-thinking/small-business/5-ways-that-poor-cash-flow-can-damage-your-business-and-how-to-prevent-it/

- https://corporatefinanceinstitute.com/resources/accounting/cash-flow-from-operations/

- https://byjus.com/commerce/difference-between-cash-flow-and-income-statement/

- https://www.score.org/resource/blog-post/11-strategies-help-generate-positive-cash-flow

- https://financenewmexico.org/articles/general-business-advice/cash-flow-is-decisive-when-pricing-a-small-business/

- https://www.investopedia.com/articles/analyst/03/122203.asp

- https://business.vic.gov.au/business-information/finance/cash-flow/cash-flow-forecasting

- https://www.thebalancemoney.com/what-is-free-cash-flow-and-how-can-you-calculate-it-393111

- https://www.iwillteachyoutoberich.com/income-producing-assets/

- https://www.investopedia.com/ask/answers/012915/what-difference-between-operating-cash-flow-and-net-income.asp

- https://online.hbs.edu/blog/post/cash-flow-vs-profit

- https://www.americanexpress.com/en-us/business/trends-and-insights/articles/how-to-calculate-cash-flow/

- https://www.investopedia.com/terms/c/cashflowstatement.asp

- https://www.forbes.com/advisor/investing/liquidity-and-liquid-assets/

- https://www.experian.com/blogs/ask-experian/cash-poor-meaning/

- https://economictimes.indiatimes.com/definition/cash-flow

- https://www.accaglobal.com/gb/en/student/exam-support-resources/fundamentals-exams-study-resources/f7/technical-articles/analysing-cashflows.html

- https://www.edgeretailacademy.com/blog-post/asset-rich-and-cash-poor-the-retailers-dilemma

- https://corporatefinanceinstitute.com/resources/accounting/operating-cash-flow-ratio/

- https://www.shopify.com/ph/blog/cash-flow-statement

- https://www.investopedia.com/articles/investing/102413/cash-flow-statement-reviewing-cash-flow-operations.asp

- https://smartasset.com/investing/liquid-assets

- https://www.investopedia.com/ask/answers/020415/what-more-important-business-profitability-or-growth.asp

- https://www.shopify.com/blog/positive-cash-flow

- https://www.investopedia.com/ask/answers/042915/what-difference-between-current-and-noncurrent-assets.asp

- https://www.investopedia.com/terms/o/operatingcashflow.asp

- https://www.landlordstudio.com/blog/how-much-profit-should-you-make-on-a-rental-property

- https://www.netsuite.com/portal/resource/articles/financial-management/cash-flow-analysis.shtml

- https://www.investopedia.com/ask/answers/122214/what-difference-between-revenue-and-income.asp

- https://www.unomaha.edu/nebraska-business-development-center/_files/publications/cash-flow.pdf

- https://www.a2entrepreneursfund.org/why-is-cash-flow-not-taxed/

- https://www.shopify.com/blog/current-asset

- https://www.pwc.com/gx/en/services/entrepreneurial-private-business/small-business-solutions/blogs/preparing-a-cash-flow-forecast-simple-steps-for-vital-insight.html

- https://www.quora.com/I-want-to-earn-1-000-USD-every-month-from-dividends-How-much-do-I-have-to-invest-and-where

- https://www.investopedia.com/ask/answers/021615/what-safest-investment.asp

- https://finance.yahoo.com/news/income-level-considered-rich-140003986.html

- https://www.unlock.com/blog/home-equity/how-to-tell-if-youre-asset-rich-cash-poor-and-what-to-do-if-you-are/

- https://redearthcpa.com/2020/03/13/why-does-my-cash-not-match-my-income-statement/

- https://www.bankrate.com/investing/best-investments-for-beginners/

- https://www.irwin-insolvency.co.uk/how-many-businesses-fail-due-to-cash-flow-problems/

- https://www.fool.com/the-ascent/small-business/accounting/articles/cash-flow-projection/

- https://www.extension.iastate.edu/agdm/wholefarm/html/c3-15.html

- https://quickbooks.intuit.com/r/cash-flow/cash-flow-problems/

- https://www.lloydsbank.com/business/resource-centre/insight/9-ways-to-improve-cash-flow.html

- https://finance.yahoo.com/news/why-stealth-wealth-best-way-120024782.html

- https://www.highradius.com/resources/Blog/weekly-cash-flow-forecast-uses/

- https://rcmycpa.com/cash-flow-vs-taxable-income-whats-the-difference/

- https://www.forwardai.com/knowledge-center/blog/80-of-businesses-fail-due-to-a-lack-of-cash-here-are-4-reasons-why-cash-flow-forecasting-is-so-important/

- https://quickbooks.intuit.com/in/resources/accounting/as-3/

- https://www.investopedia.com/ask/answers/111714/whats-more-important-cash-flow-or-profits.asp

- https://finmark.com/cash-flow-vs-net-income/

- https://www.investopedia.com/ask/answers/031215/what-difference-between-cash-flow-statement-and-income-statement.asp

- https://quickbooks.intuit.com/r/cash-flow/critical-difference-profit-cash-flow/

- https://homework.study.com/explanation/liquidity-is-a-measure-of-how-a-quickly-an-asset-may-be-converted-into-cash-b-long-an-asset-can-be-used-c-easily-an-asset-can-be-exchanged-for-another-asset-d-quickly-an-asset-appreciates-in-value.html

- https://gocardless.com/en-us/guides/posts/how-to-prepare-cash-flow-statement/

- https://www.motilaloswal.com/blog-details/why-cash-flows-matter-more-than-the-profits-of-a-company/1762

- https://www.growthforce.com/blog/7-strategies-for-surviving-a-cash-flow-crisis

- https://www.empower.com/the-currency/money/what-are-liquid-assets

- https://www.investopedia.com/ask/answers/05/060105.asp

- https://www.abc-amega.com/articles/understanding-the-cash-flow-statement/

- https://online.hbs.edu/blog/post/how-to-prepare-a-cash-flow-statement

- https://www.linkedin.com/pulse/difference-between-broke-poor-warden-rhino

- https://www.freshbooks.com/hub/accounting/what-can-be-depreciated

- https://finmark.com/what-is-cash-flow-statement/

- https://www.indeed.com/career-advice/career-development/cash-flow-vs-net-income

- https://www.investopedia.com/ask/answers/011315/what-difference-between-cash-flow-and-revenue.asp

- https://www.investopedia.com/terms/c/cashflow.asp

- https://testbook.com/question-answer/the-assets-which-can-be-converted-into-cash-within--63a071d871a9001aa8652c6a

- https://www.investopedia.com/articles/basics/11/3-s-simple-investing.asp

- https://fmx.cpa.texas.gov/fmx/pubs/afrrptreq/gen_acct/index.php?section=cash_flow&page=classifying

- https://www.digitalocean.com/resources/article/cash-flow-vs-profit

- https://www.investopedia.com/terms/b/business-activities.asp

- https://agicap.com/en/article/cash-inflow/

- https://www.mindmesh.com/glossary/what-is-positive-cash-flow

- https://countingup.com/resources/what-is-a-healthy-cash-flow-ratio/

- https://www.inc.com/encyclopedia/cash-flow-statement.html

- https://en.wiktionary.org/wiki/cash_poor

- https://www.lawinsider.com/dictionary/average-monthly-cash-flow

- https://www.quora.com/Is-it-possible-to-create-endless-cash-flow-without-having-any-work-or-doing-anything-for-their-money

- https://study.com/academy/lesson/quality-of-income-ratio-definition-formula-analysis.html

- https://time.com/personal-finance/article/passive-income-ideas/

- https://www.experian.co.uk/blogs/latest-thinking/small-business/why-is-cash-flow-management-important/

- https://www.thehartford.com/business-insurance/strategy/manage-cash-flow/best-practices

- https://www.firstrepublic.com/insights-education/what-are-liquid-assets

- https://www.aabrs.com/company-has-cash-flow-problems/

- https://www.americanexpress.com/en-us/business/blueprint/resource-center/finance/how-long-can-a-business-operate-with-negative-cash-flow/

- https://www.forbes.com/sites/forbesbusinesscouncil/2021/07/05/a-healthy-cash-flow-the-most-crucial-element-for-sustained-growth/

- https://agicap.com/en/article/cash-flow-positive/

- https://www.waveapps.com/blog/cash-flow-formula

- https://www.law.cornell.edu/wex/liquid_asset

- https://www.investopedia.com/ask/answers/032615/what-are-some-examples-cash-flow-operating-activities.asp

- https://www.manulife.com.sg/en/insights/asset-rich-cash-poor-how-insurance-can-be-a-liquidity-source.html

- https://homework.study.com/explanation/when-might-a-negative-cash-flow-be-considered-positive-provide-an-example-and-explain.html

- https://www.investopedia.com/ask/answers/111714/what-are-some-examples-how-cash-flows-can-be-manipulated-or-distorted.asp

- https://homework.study.com/explanation/what-are-the-three-basic-patterns-of-cash-flow-choose-one-to-define-and-explain-how-to-calculate-the-future-and-present-value-of-the-cash-flow-that-you-select.html

- https://www.pnc.com/insights/small-business/running-your-business/why-small-businesses-fail.html

- https://quizlet.com/11265772/ch-2-financial-statements-taxes-and-cash-flow-flash-cards/

- https://gocardless.com/en-us/guides/posts/cash-flow-vs-profit/

- https://www.makingsenseofcents.com/2023/09/income-generating-assets.html

- https://smartasset.com/investing/how-a-company-can-succeed-without-making-a-profit

- https://carminemastropierro.com/2000-month-passive-income/

- https://aofund.org/resource/how-write-cash-flow-statement/

- https://www.british-business-bank.co.uk/finance-hub/what-is-cash-flow-how-do-you-manage-it/

- https://www.linkedin.com/pulse/1-rule-real-estate-investing-evaluating-properties-positive

- https://www.investopedia.com/articles/personal-finance/061215/10-ways-improve-cash-flow.asp

- https://www.landlordstudio.com/blog/how-much-rental-cash-flow-is-good

- https://www.bankofamerica.com/smallbusiness/resources/post/free-cash-flow/

- https://www.patriotsoftware.com/blog/accounting/tangible-assets/

- https://www.investopedia.com/articles/stocks/07/easycashflow.asp

- https://www.freshbooks.com/hub/accounting/cash-flow-formula

- https://www.nasdaq.com/articles/the-smartest-stocks-to-buy-with-$20-right-now-and-hold-forever-13