What is a real life example of zero-based budgeting?

For example, let's say you're using zero based budgeting for your monthly expenses. You begin by listing all your sources of income, then allocate funds to different categories such as rent, groceries, utilities, and entertainment. This method encourages intentional spending and helps you maximize your money.

Zero-based budgeting is a method that has you allocate all of your money to expenses for needs and wants, as well as short- and long-term savings and debt payments. The goal is that your income minus your expenditures equals zero by the end of the month.

By scrutinizing each line-item expense from scratch, ZBB helps identify unnecessary or redundant costs, preventing overspending. This process allows for cost-cutting and setting savings goals, leading to lower costs and improved financial efficiency.

Zero-based budgeting (ZBB) is a budgeting technique in which all expenses must be justified for a new period or year starting from zero, versus starting with the previous budget and adjusting it as needed.

This is a methodology used by Amazon which I learnt as finance leader of their China business. Within a depressed economic environment, it has gained renown as an effective way of managing costs and is known as Zero Based Budgeting (ZBB). Whilst I call it a methodology, at Amazon it was more a mindset.

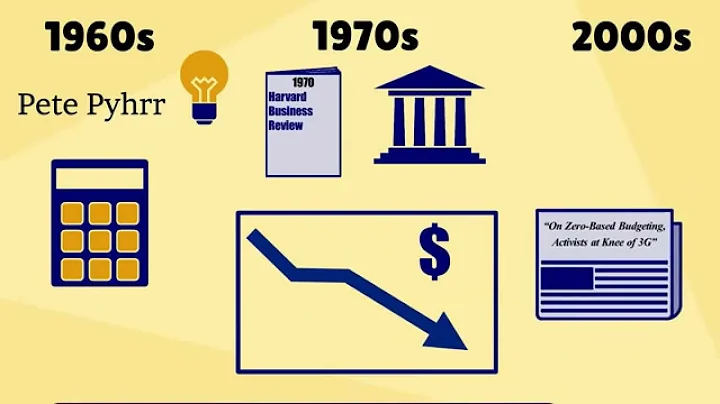

Zero-based budgeting (ZBB) is a budgeting method that requires all expenses to be justified and approved in each new budget period, typically each year. It was developed by Peter Pyhrr in the 1970s.

In a traditional budgeting approach, last year's budget might be used as a starting point. However, with Zero-Based Budgeting, the hotel starts from zero. It analyzes the costs associated with room service, considering factors like ingredients, staff salaries, equipment, and marketing.

A zero-based budget or ZBB (as the cool kids would say), is a method where you allocate every dollar of your income and assign it to either an expense or savings goal. Simply put, you take all your income sources and subtract your expenses and savings, to equal zero.

ZBB, also known as every dollar budget, is a type of budgeting method where you start with a clean slate. The idea is to justify every expense before including it in the budget.

Zero-based budgeting forces managers to justify each dollar in the budget to ensure that some expenses are lower in a current year compared to what they were in previous years.

Why is the zero-based budget the most effective?

Zero-based budgeting ensures that managers think about how every dollar is spent and they must do so every budgeting period. This process also forces them to justify all operating expenses and to consider which areas of the company are generating revenue.

A few popular choices that are ideal for zero-based budgets include You Need a Budget (YNAB), EveryDollar, and Mint by Intuit. Each of these apps will allow you to quickly categorize every dollar of your earnings and keep tabs on your monthly spending.

A zero-based approach seeks to link organizational designs to strategic priorities (for example, areas for investment compared with efficiency optimization) instead of a “one-size-fits-all” solution across the business.

Dave recommends telling every dollar where it should go—before the month begins—using a zero-based budget. This means that your income minus your expenses equals zero. Remember that feeling you had when you found $20 in your old coat pocket? That's the same feeling you'll have when you create (and stick to) a budget.

The premise of ZBB is that each individual budget in the district is built from scratch; forcing decision leaders and budget owners to justify their existing and new spending according to district criteria.

Budget inflation: Since every line item is to be justified, a zero-based budget overcomes the weakness of incremental budgeting of budget inflation.

The nature of zero-based budgeting requires you to keep your fingers on your cash flow- you are fully aware of how much money flows in and out of your business. Better Decision Making: Zero based budgeting results in a more strategic allocation of planned spend.

Traditional budgeting is based on historical information, which revolves around accounting. Zero-based budgeting is based on estimated data, and that's why it revolves around decision-making. Traditional budgeting encourages similar costing to the previous year. Zero-based budgeting supports cost-effectiveness.

Although ZBB is often credited with measures to reduce costs, its approach doesn't exclusively focus on savings. It can also help test assumptions, solve problems, and ensure spending is aligned to your company's growth objectives. Organizations using an effective approach to ZBB report a multitude of benefits.

Generally, “pay yourself first” means what it says—set aside money for savings before paying bills and making other purchases. But it's still important to keep up with debt obligations. Automatic transfers can make it easier to pay yourself first.

Is Mint going away in 2024?

Mint has long been revered as one of the best budgeting apps on the market. But as of Jan. 1, 2024, the platform will be shut down and users will need an alternative for their money-tracking needs.

Intuit has announced it will shut down the personal finance app Mint on January 1, 2024. Intuit is asking Mint users to move to Credit Karma, one of the company's other personal-finance platforms.

The reason for closing down the Mint app is the supposed consolidation of Intuit's personal finance products and to prioritize their focus on Credit Karma, which has more features and functions than Mint. However, some key features that made Mint what it is are said not to be available in Credit Karma, like budgeting.

For example, let's say you're using zero based budgeting for your monthly expenses. You begin by listing all your sources of income, then allocate funds to different categories such as rent, groceries, utilities, and entertainment. This method encourages intentional spending and helps you maximize your money.

There are three types of budgets namely a surplus budget, a balanced budget, and a deficit budget. A financial document that comprises revenue and expenses over a year is the government budget. The annual statement that comprises the estimation of expenses and revenue is called a budget.

References

- https://www.forbes.com/advisor/banking/how-to-save-1000-a-month/

- https://www.bankrate.com/banking/savings/30-day-savings-rule/

- https://www.ramseysolutions.com/budgeting/how-to-budget

- https://www.whitehouse.gov/wp-content/uploads/2021/05/ap_6_concepts_fy22.pdf

- https://www.thrivent.com/insights/budgeting-saving/what-does-it-mean-to-pay-yourself-first

- https://www.moneylion.com/learn/key-components-of-successful-budgeting/

- https://www.investopedia.com/ask/answers/051515/what-are-advantages-and-disadvantages-zerobased-budgeting-accounting.asp

- https://www.chase.com/personal/banking/education/budgeting-saving/how-much-income-should-go-to-rent

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.nerdwallet.com/article/finance/how-to-budget

- https://www.linkedin.com/advice/0/what-benefits-challenges-using-zero-based-budgeting

- https://www.chase.com/personal/banking/education/budgeting-saving/budget-spreadsheet

- https://www.citizensbank.com/learning/50-30-20-budget.aspx

- https://www.financestrategists.com/accounting/budgeting/zero-based-budgeting-zbb/

- https://www.truesky.com/3-essential-elements-of-a-budget/

- https://finlit.yale.edu/planning/budgeting-and-goal-setting

- https://www.indeed.com/career-advice/career-development/what-does-master-budget-include

- https://quizlet.com/242326100/finance-money-in-review-2-flash-cards/

- https://www.easilyeconomics.com/zero-base-budgeting-a-short-notes/

- https://homework.study.com/explanation/the-budget-should-always-be-prepared-first.html

- https://m.economictimes.com/news/economy/policy/types-of-government-budget-in-india-what-are-the-three-types-of-government-budgets/articleshow/106083561.cms

- https://en.wikipedia.org/wiki/Zero-based_budgeting

- https://www.british-business-bank.co.uk/finance-hub/zero-based-budgeting/

- https://www.oracle.com/performance-management/planning/zero-based-budgeting/

- https://www.moneyhelper.org.uk/en/everyday-money/budgeting/budget-planner

- https://www.mckinsey.com/capabilities/operations/our-insights/zero-based-productivity-organization-using-zero-based-principles-to-forge-a-purpose-built-organization

- https://www.financiallifocused.com/5-dangers-of-not-having-a-budget/

- https://empoweringstewardship.com/en/Resources/Church-Budgeting-Finances/Appropriate-Budget-Percentages-for-Church-Expenses

- http://mappingyourfuture.org/money/budget.cfm

- https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

- https://homework.study.com/explanation/what-are-the-three-3-major-objectives-of-budgeting-and-why-are-they-important-to-an-organization.html

- https://www.forbes.com/advisor/banking/guide-to-50-30-20-budget/

- https://chisellabs.com/glossary/what-is-zero-based-budgeting/

- https://www.nibusinessinfo.co.uk/content/advantages-and-disadvantages-business-budgeting

- https://www.cnbc.com/select/mint-app-shutting-down-what-users-should-do/

- https://quizlet.com/138217560/healthcare-finance-test-flash-cards/

- https://www.opploans.com/oppu/financial-literacy/80-20-budget/

- https://quizlet.com/175468699/chapter-7-flash-cards/

- https://www.wallstreetmojo.com/traditional-budgeting-vs-zero-based-budgeting/

- https://www.accountingtools.com/articles/rule-of-69

- https://www.tutor2u.net/business/reference/budgets-limitations-and-potential-problems

- https://www.cnbc.com/select/reasons-your-budget-may-not-be-working/

- https://fortune.com/recommends/banking/zero-based-budgeting/

- https://www.ramseysolutions.com/budgeting/american-average-monthly-expenses

- https://hr.nih.gov/working-nih/competencies/competencies-dictionary/budget-calculation

- https://www.irs.gov/businesses/small-businesses-self-employed/what-is-taxable-and-nontaxable-income

- https://www.phonepe.com/blog/investments/plan-your-finances-in-5-simple-steps/

- https://medium.com/@ceovivekbindra/what-is-zero-based-budgeting-and-its-steps-to-implement-in-business-f6e7946b4ad3

- https://www.colorado.edu/health/blog/budgeting-tips

- https://fortune.com/recommends/banking/how-to-save-money-fast/

- https://www.bankrate.com/banking/how-to-make-a-monthly-budget/

- https://www.lendingtree.com/student/simple-budget/

- https://iamswealthmanagement.com/wp-content/uploads/2020/08/Rules-of-100.pdf

- https://www.capitalone.com/learn-grow/money-management/monthly-expenses/

- https://spiritfinancialcu.org/what-does-a-realistic-budget-look-like

- https://www.linkedin.com/pulse/what-amazon-taught-me-cost-management-cornell-tsiang

- https://www.linkedin.com/advice/1/what-key-steps-create-zero-based-budget

- https://www.canada.ca/en/financial-consumer-agency/services/make-budget.html

- https://www.earnest.com/blog/rent-and-the-30-percent-rule/

- https://money.usnews.com/money/personal-finance/spending/articles/how-the-70-20-10-budget-rule-works

- https://www.linkedin.com/advice/1/what-best-ways-talk-your-budgeting-experience-management-advice-zqdjc

- https://www.nerdwallet.com/article/finance/how-much-should-i-save-each-month

- https://www.anaplan.com/blog/zbb-zero-based-budgeting-guide/

- https://www.ageuk.org.uk/globalassets/age-uk/documents/factsheets/fs24_personal_budgets_and_direct_payments_in_social_care_fcs.pdf

- https://www.fidelity.com/learning-center/smart-money/zero-based-budgeting

- https://www.boh.com/blog/3-easy-steps-to-creating-a-smart-budget

- https://www.globalatlantic.com/professionals/thriving-practice/market-insights/rule-120

- https://www.zeni.ai/blog/zero-based-budgeting

- https://www.bankrate.com/banking/savings/52-week-savings-challenge/

- https://www.nerdwallet.com/article/finance/what-is-a-budget

- https://blog.allovue.com/zero-based-budgeting

- https://www.meettally.com/blog/monthly-expenses

- https://www.ibm.com/blog/what-is-zero-based-budgeting/

- https://www.growthforce.com/blog/can-zero-based-budgeting-drive-growth-in-your-business

- https://www.pigment.com/blog/zero-based-budgeting-overview

- https://mrsc.org/getmedia/c52f539c-adad-41c1-8421-6584ed3ba8d9/gfoazero.pdf

- https://paristech.com/blog/avoid-bad-budgeting-ben-wann/

- https://www.gobankingrates.com/saving-money/savings-advice/what-is-the-27-40-rule/

- https://www.commbank.com.au/articles/saving-and-budgeting/how-to-make-a-budget.html

- https://www.businessinsider.com/personal-finance/mint-shutting-down-alternative-budgeting-apps-2023-11

- https://blog.logrocket.com/product-management/why-is-the-mint-app-shutting-down/

- https://www.ramseysolutions.com/budgeting/how-to-make-a-zero-based-budget

- https://srfs.upenn.edu/financial-wellness/browse-topics/budgeting/popular-budgeting-strategies

- https://www.indeed.com/career-advice/career-development/zero-based-budget

- https://www.joellynferguson.com/6-reasons-to-answer-whats-your-budget/

- https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/creating-a-budget

- https://www.pnc.com/insights/personal-finance/spend/four-common-budgeting-mistakes-how-to-avoid-them.html

- https://www.forbes.com/advisor/banking/budget-calculator/

- https://www.myhubble.money/blog/the-40-30-20-10-rule-to-saving-and-spending-money

- https://testbook.com/question-answer/which-of-the-following-statements-isare-correct--5fc0e6c8fc952e0f8f86d8d1

- https://busykid.com/blog/financial-success-really-comes-down-to-4-basic-money-rules/

- https://onaccounting.co.za/difference-between-traditional-budgeting-and-zero-based-budgeting/

- https://www.fool.com/the-ascent/personal-finance/articles/5-pitfalls-of-using-budgeting-apps/

- https://www.nerdwallet.com/article/finance/zero-based-budgeting-explained

- https://www.nasdaq.com/articles/8-easy-ways-to-save-$20000-on-your-salary-in-one-year

- https://consumer.gov/managing-your-money/making-budget

- https://coinswitch.co/switch/personal-finance/what-is-zero-based-budgeting/

- https://www.linkedin.com/pulse/5-budgeting-methods-everyone-should-know-about-advantages-ehab-sobhy

- https://www.g3pconsulting.com/en/reliability-maintenance-management/zero-based-budget-and-cost-control

- https://www.loqbox.com/en-gb/blog/70-20-10-rule-for-money-budgets-as-seen-on-tiktok

- https://www.worldwidejournals.com/paripex/recent_issues_pdf/2016/October/zerobased-budgeting_October_2016_5099160494_7907655.pdf

- https://www.investopedia.com/terms/z/zbb.asp

- https://havenlife.com/blog/zero-based-budgeting/

- https://www.paducahbank.com/Learn/Resources/Financial-Literacy/How-to-Make-a-Simple-Budget

- https://byjusexamprep.com/upsc-exam/what-are-the-three-types-of-budget

- https://www.indeed.com/career-advice/career-development/costs-vs-expenses

- https://paro.ai/blog/advantages-disadvantages-zero-based-budgeting/

- https://www.mydoh.ca/learn/blog/banking/what-is-a-zero-based-budget-a-guide-for-parents-and-teens/

- https://planergy.com/blog/advantages-and-disadvantages-of-zero-based-budgeting/

- https://www.indeed.com/career-advice/career-development/zero-based-budgeting

- https://www.attitudefinancialadvisors.com/investing-basics-101-budgeting-basics-to-help-you-set-aside-money-for-investing-part-1/

- https://quizlet.com/445390012/exam-3-flash-cards/

- https://www.cnbc.com/select/tips-to-make-sure-you-dont-overspend-on-your-credit-card/

- https://money.com/how-much-house-can-i-afford/

- https://time.com/personal-finance/article/how-to-plan-for-retirement/

- https://www.sofi.com/learn/content/signs-you-do-not-make-enough-money/

- https://www.capitalone.com/learn-grow/money-management/pay-yourself-first/

- https://finance.yahoo.com/news/grant-cardone-swears-40-40-110053843.html

- https://advancedstructures.in/zero-based-costing/

- https://www.investopedia.com/financial-edge/1109/6-reasons-why-you-need-a-budget.aspx

- https://revenue-hub.com/mastering-success-zero-based-budgeting-for-hotels/